In the ever-evolving and intricate world of digital finance, the crypto market heatmap has emerged as a pivotal tool for traders and investors alike. These dynamic and colorful representations distill the complex movements of the market into an intuitive visual language that transcends traditional numeric data.

But what exactly are cryptocurrency heatmaps, and how can they transform the way we interact with the digital currency space?

Understanding Cryptocurrency Heatmaps

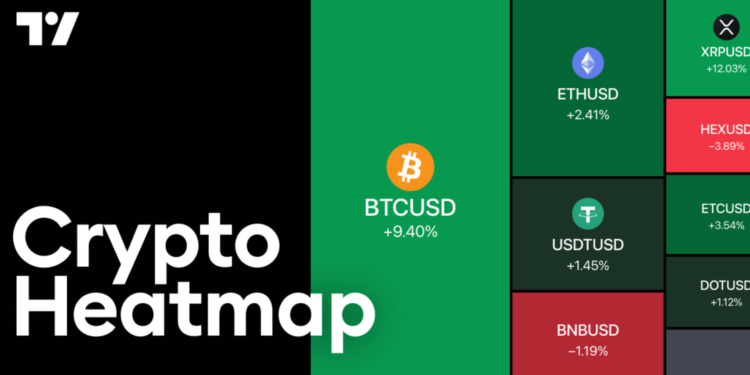

At their core, cryptocurrency heatmaps are a graphical representation of performance metrics across different cryptocurrencies. Much like their meteorological counterparts, these heatmaps utilize color gradients to denote varying degrees of activity or value change in the market.

A traditional financial heatmap might showcase stocks or sectors, but a crypto heatmap focuses exclusively on digital currencies like Bitcoin, Ethereum, and thousands of altcoins. The utility of a cryptocurrency heatmap lies in its ability to provide a snapshot of the market sentiment at a glance.

They can highlight which coins are experiencing significant movement, whether bullish or bearish. Typically, warm colors such as red and orange signify a decrease in value, while cooler colors like green and blue indicate an increase.

This instant visual feedback is instrumental for crypto enthusiasts who need to make swift and informed decisions.

The Yahoo Cryptocurrency Heatmap: A Case Study

One of the more renowned examples comes from internet giant Yahoo with its Yahoo cryptocurrency heatmap. They enable users to monitor the performance of various cryptocurrencies in real time.

The Yahoo platform provides an accessible and user-friendly interface that integrates seamlessly with its other financial tools and news reports. This compatibility has made it a go-to resource for both novice and expert traders seeking a quick pulse on market trends.

How To Use Heatmaps Effectively

Incorporating how to use heatmaps into your trading strategy can dramatically enhance your market analysis. Here’s how to make the most of them:

Identify Market Trends

Heatmaps can quickly point you to the prevailing trend in the cryptocurrency market. Use the color coding to spot general market momentum, whether the day is dominated by sell-offs or buy-ins.

Instant Comparison

With just a quick look, you can compare the performance of various cryptocurrencies. This can help you identify outliers that are either outperforming or underperforming relative to the market.

Seize Opportune Moments

By noticing shifts in color on the heatmap, you may pinpoint the optimal moments to enter or exit trades. For instance, spotting a coin that’s turning from orange to yellow could signal a potential rebound from a dip.

Diversification Decisions

If your portfolio is too concentrated in assets that consistently show the same color on the heatmap, it might indicate a need for diversification. It’s a visual cue that you could be overexposed to similar market risks.

Sentiment Analysis

Heatmaps can also serve as a proxy for market sentiment, offering a peek into where the majority of traders are leaning. This can be a critical factor when considering following the crowd or contrarian investing.

In conclusion, whether you’re a seasoned trader or just getting your feet wet in the world of digital currencies, a crypto market heatmap is an invaluable ally. By turning complex data into a burst of color, heatmaps not only simplify market analysis but also add a touch of artistic flair to the serious business of cryptocurrency trading.

Embrace the vibrancy of these tools, and let them guide you through the digital market’s ebb and flow with confidence and clarity.